Florida sales tax guide for SaaS businesses

Is your product taxable in Florida? Get up-to-date rates, nexus thresholds, and more from Anrok’s team of tax experts.

Automate sales tax for SaaS

2025 SaaS sales tax rates for Florida

Reach out to our team to start automating compliance for your business.

Tax rates

Nexus thresholds

Products taxed

Table of contents

Latest updates

Is SaaS taxable in Florida?

Currently, Florida is one of the few states in the US that does not explicitly impose a sales tax on SaaS or other digital products.

Despite the absence of clear legislation taxing SaaS, it is essential to understand that taxability can always be subject to interpretation by the Florida Department of Revenue (FDOR) and may change with future regulations.

While SaaS companies do not have to worry about sales tax in Florida for the time being, it is crucial to stay informed about regulatory changes to avoid any potential tax liabilities.

How to determine if your product is taxable in Florida

Although SaaS is not currently taxable in Florida, other services and products may be. The first step in determining your product’s taxability in Florida is to identify whether it falls under a taxable category.

Next, it is necessary to understand the concept of nexus. Nexus, also known as a tax presence, refers to the connection between a business and a state that requires the business to collect and remit sales tax within that state. Florida has specific nexus laws that govern the taxability of businesses operating within its jurisdiction.

In Florida, there are several situations that create sales tax nexus for your business, such as:

- Having an office or other business location within the state.

- Having employees, agents, or representatives working in the state.

- Storing inventory in Florida, such as in a warehouse or distribution center.

- Maintaining a substantial number of remote sellers who are required to collect and remit Florida sales tax.

- Thresholds for economic nexus, such as having more than $100,000 in sales within a calendar year.

If your business has nexus in Florida and sells taxable products or services, you are required to collect and remit sales tax to the state.

Sales tax compliance in Florida

Ensuring sales tax compliance in Florida can be a complex task due to the state’s sales tax laws, especially for businesses dealing with digital products and services. However, by following a few simple steps, you can minimize the risk of non-compliance and potential penalties:

- Keep up-to-date with Florida’s tax laws and nexus thresholds to understand your business’s tax obligations.

- Register for a Florida sales tax permit if required due to nexus or taxability of your products.

- Collect sales tax from your Florida customers based on your product’s taxability and Florida’s tax rates.

- File and remit sales tax returns regularly, along with any required payments, to the Florida Department of Revenue.

- Seek assistance from tax professionals to ensure proper compliance with Florida’s tax laws and regulations.

While SaaS is not currently taxable in Florida, it is crucial for businesses to stay informed about tax laws and regulations in the state. By maintaining an understanding of taxability, nexus laws, and sales tax compliance, businesses can navigate the complexities of Florida sales tax and minimize potential liabilities and penalties.

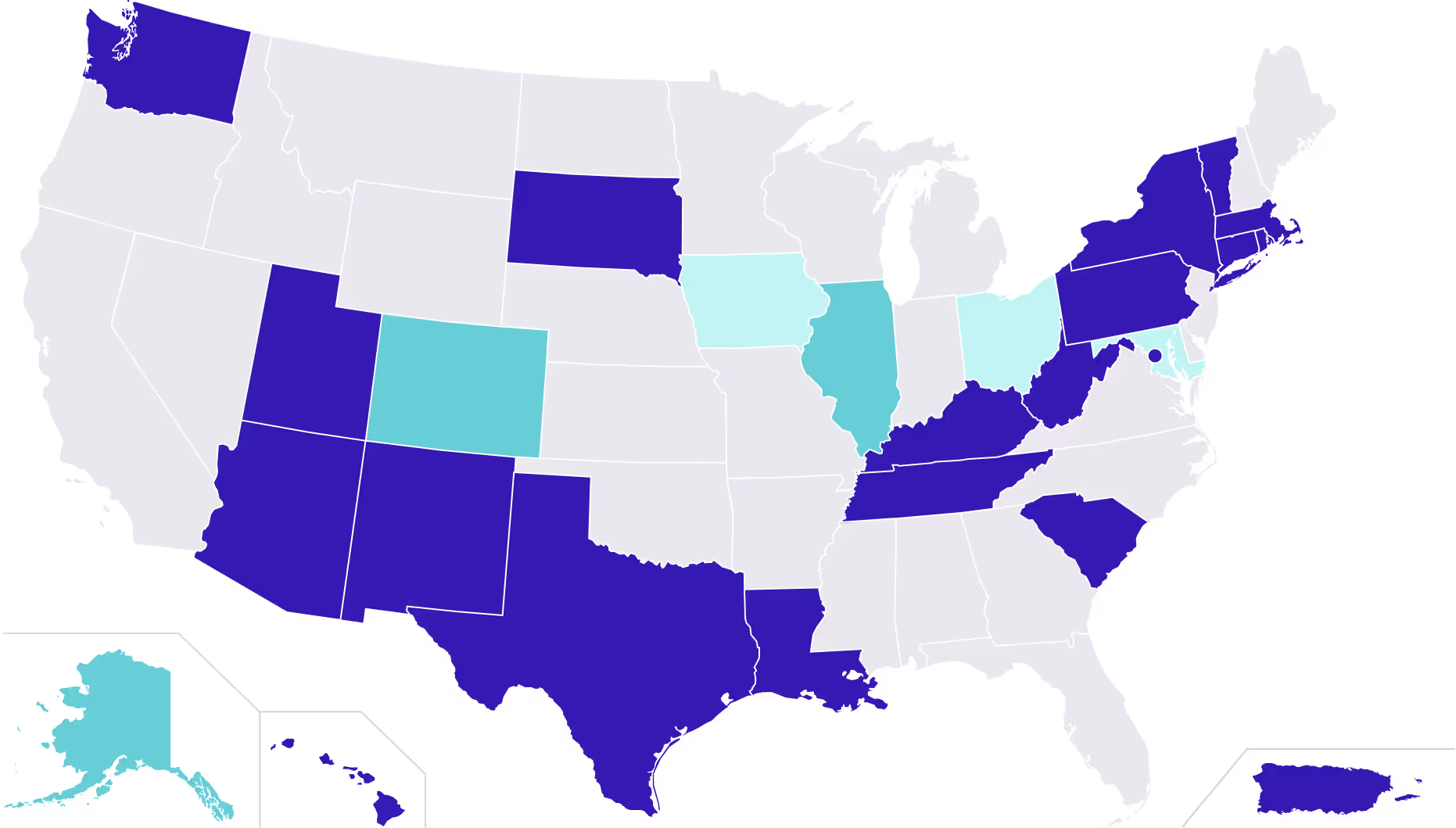

SaaS sales tax rates for every state

Up-to-date sales tax rates, nexus thresholds, and product taxability for every state, built by Anrok’s team of SaaS tax experts.

Explore the index

Automated sales tax compliance, built for SaaS

Connect your financial stack

Sync your billing, payment, and HR systems with just a few clicks

Monitor exposure across the globe

Instantly see how growing sales affect your liability—and quickly take action

Calculate sales tax in real time

Always collect the right tax, with the most accurate rules for SaaS

File and report on autopilot

Built-in filing, remittance, and reconciliation simplify reporting

%20(1).webp)