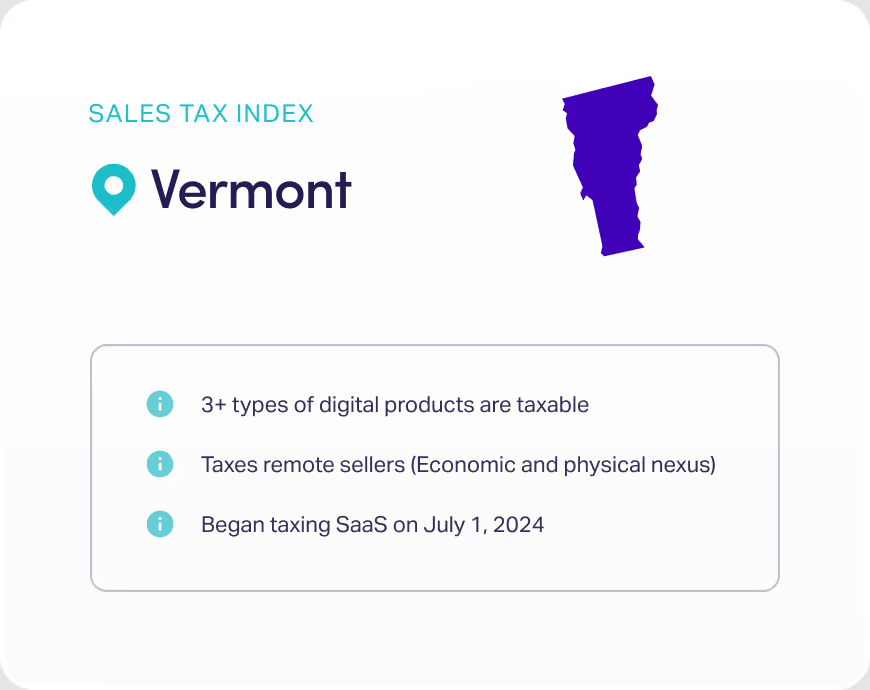

Vermont sales tax guide for SaaS businesses

Is your product taxable in Vermont? Get up-to-date rates, nexus thresholds, and more from Anrok’s team of tax experts.

Automate sales tax for SaaS

2025 SaaS sales tax rates for Vermont

Reach out to our team to start automating compliance for your business.

Tax rates

Nexus thresholds

Products taxed

Table of contents

Latest updates

Is SaaS taxable in Vermont?

Though taxation laws can vary from state to state, Vermont does not tax SaaS unless it is hosted on a server owned by the customer located in Vermont. The state does tax a variety of digital products.

While the taxation of digital products can be complex and challenging, it’s crucial for businesses to remain compliant with the latest regulations. By working with tax professionals and leveraging technology solutions, businesses can simplify their tax compliance efforts and avoid costly penalties.

How to determine if your product is taxable in Vermont

As a business owner, it’s essential to know if your product or service is subject to sales tax in Vermont. This starts with accurately classifying your product under state law based on its specific functionality. It can be helpful to consult a tax professional to ensure you’re properly identifying your product’s taxability.

Understanding sales tax nexus laws in Vermont is also critical, as these laws dictate when and where a company is obligated to collect and remit sales tax. Nexus is the relationship between a state and a business that requires the business to collect sales tax there. Vermont has two nexus types: physical and economic nexus.

Physical nexus is established when a company maintains a location, employees, or assets within Vermont. This connection can be a result of a physical retail store, warehouse, or an employee who resides in the state.

On the other hand, economic nexus is based on the level of economic activity a firm engages in within the state. Vermont’s current economic nexus threshold is $100,000 in annual sales or 200 transactions to Vermont customers within a 12-month period. Companies exceeding these thresholds will be required to register for sales tax collection and remittance.

Sales tax compliance in Vermont

Maintaining sales tax compliance in Vermont requires businesses to follow a few steps:

- Register for a sales tax permit: All businesses with nexus in Vermont must register for a sales tax permit.

- Collect sales tax: Once you have your sales tax permit, you need to collect the appropriate amount of sales tax on taxable transactions, including any taxable SaaS products and digital goods.

- File sales tax returns: Businesses must file periodic sales tax returns, typically on a monthly, quarterly, or annual basis, depending on the sales volume. When filing the return, you need to report the total sales and taxable sales, as well as the sales tax collected during the reporting period.

- Remit collected sales tax: Along with filing your sales tax return, you must also remit the collected sales tax to the state. Failure to do so could result in penalties and interest charges.

Given the complexity of sales tax regulations, consulting with a qualified tax professional or utilizing tax software can help businesses in Vermont stay compliant, avoid penalties, and respond accurately to any changes in state tax laws.

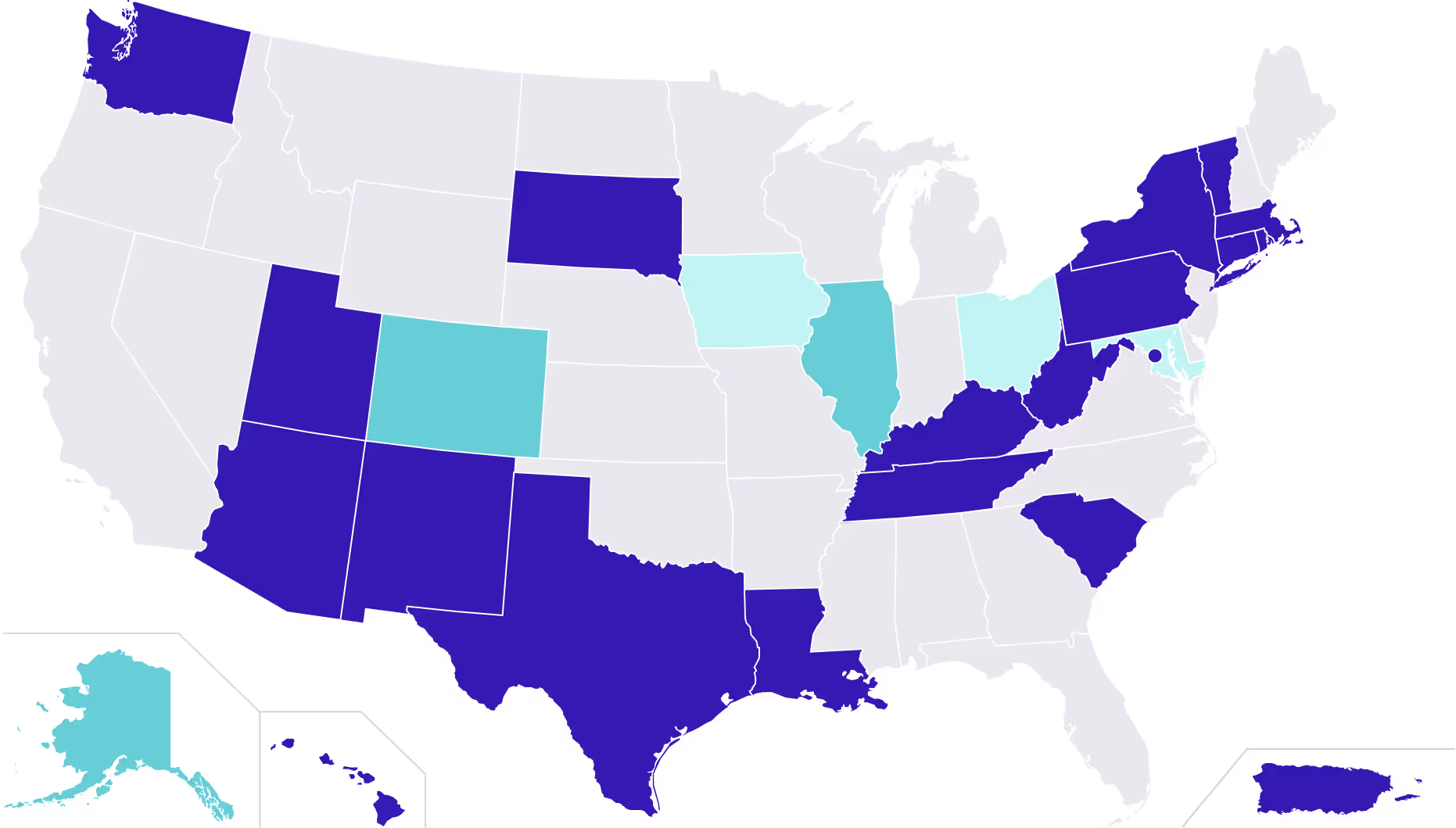

SaaS sales tax rates for every state

Up-to-date sales tax rates, nexus thresholds, and product taxability for every state, built by Anrok’s team of SaaS tax experts.

Explore the index

Automated sales tax compliance, built for SaaS

Connect your financial stack

Sync your billing, payment, and HR systems with just a few clicks

Monitor exposure across the globe

Instantly see how growing sales affect your liability—and quickly take action

Calculate sales tax in real time

Always collect the right tax, with the most accurate rules for SaaS

File and report on autopilot

Built-in filing, remittance, and reconciliation simplify reporting

%20(1).webp)